Growing a business often requires big investments. Many business owners want to buy commercial property, purchase expensive equipment, or expand their facilities, but the cost is too high to pay upfront. Traditional bank loans for these purposes often require large down payments, short repayment terms, and strong credit. Because of these barriers, many small businesses delay growth or miss opportunities entirely. To solve this problem, the U.S. government supports a special financing option called the SBA 504 loan.

The SBA 504 loan program is designed specifically to help small businesses finance major fixed assets. It is different from other SBA loans and is often misunderstood. Some business owners think it is too complicated. Others confuse it with SBA 7(a) loans. In reality, the SBA 504 loan is one of the best tools available for long-term business growth when large purchases are involved.

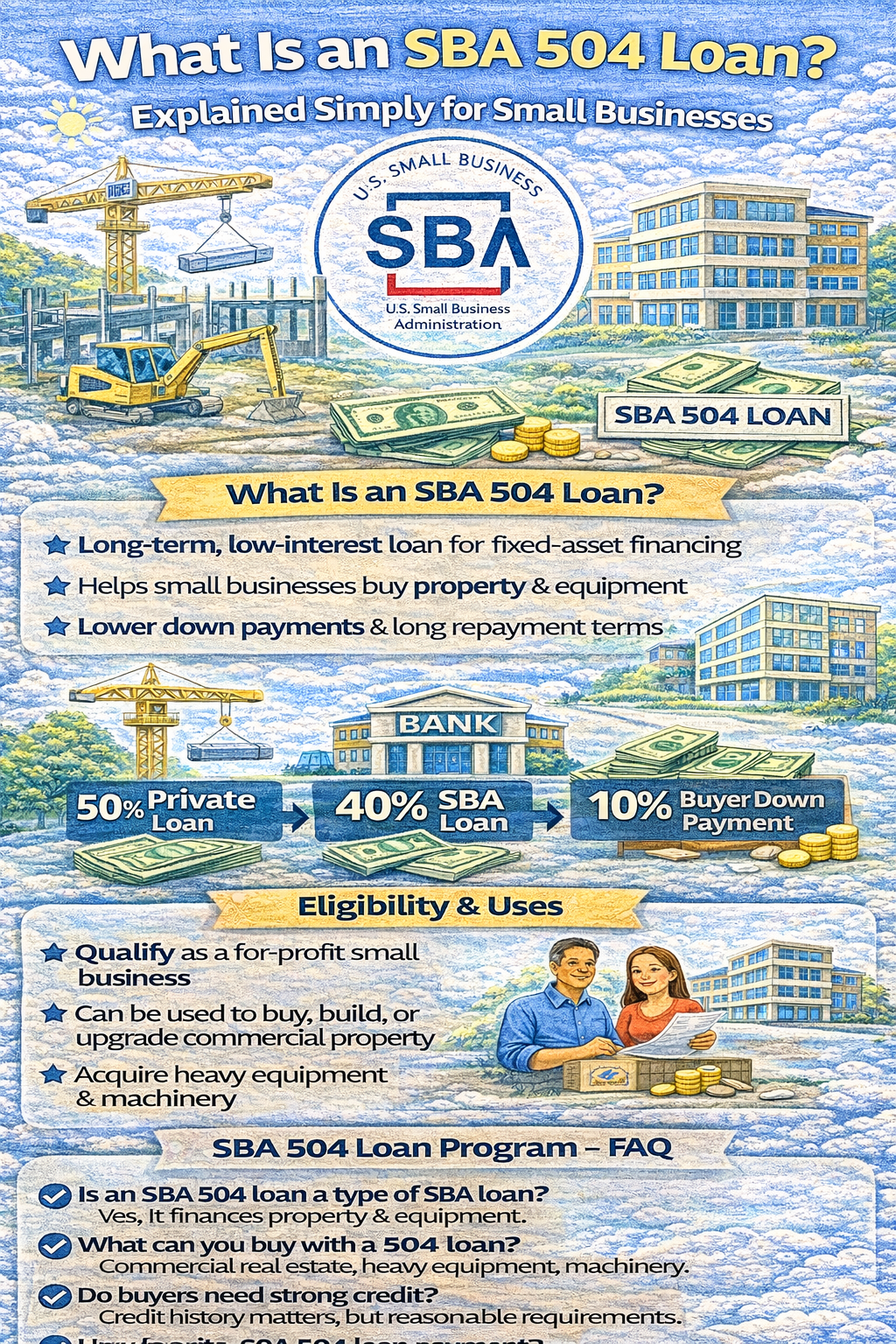

What Is an SBA 504 Loan?

An SBA 504 loan is a long-term, low-interest loan designed to help small businesses buy major fixed assets. These assets usually include commercial real estate, large equipment, or machinery that will be used for business operations.

Unlike many other loans, the SBA 504 loan is not provided by just one lender. Instead, it is structured through a partnership between a private lender, a nonprofit organization, and the government. This structure helps reduce risk and makes financing more affordable for small businesses.

Who Runs the SBA 504 Loan Program?

The SBA 504 loan program is overseen by the U.S. Small Business Administration. The SBA does not lend money directly, but it sets the rules and guarantees part of the loan.

A key partner in the 504 loan program is a Certified Development Company (CDC). CDCs are nonprofit organizations approved by the SBA to help promote economic development in local communities. They work with lenders and business owners to structure and process SBA 504 loans.

What Can an SBA 504 Loan Be Used For?

SBA 504 loans are strictly for fixed assets. This means the funds must be used for long-term business investments, not everyday expenses.

These loans can be used to buy commercial real estate such as office buildings, warehouses, or retail space. They can also be used to purchase heavy machinery, manufacturing equipment, or large tools used in operations.

What Cannot Be Used With an SBA 504 Loan?

SBA 504 loans cannot be used for short-term or operational expenses. This includes payroll, rent, utilities, inventory, or marketing costs.

They also cannot be used for speculative investments or passive real estate, such as rental properties that are not owner-occupied. The business must use a large portion of the property for its own operations.

SBA 504 Loan Interest Rates

One of the biggest benefits of the SBA 504 loan program is its fixed interest rates. The SBA-backed portion of the loan usually comes with a fixed rate for the life of the loan.

This means monthly payments remain stable and predictable, which helps with long-term financial planning. Interest rates are generally competitive and often lower than traditional commercial loans.

SBA 504 Loan Repayment Terms

SBA 504 loans are designed for long-term repayment. Repayment terms are usually 10, 20, or 25 years, depending on the type of asset being financed.

Long repayment terms mean lower monthly payments, making large purchases more manageable for small businesses.

Who Qualifies for an SBA 504 Loan?

To qualify for an SBA 504 loan, a business must meet SBA size standards and operate as a for-profit business in the United States.

The business must show the ability to repay the loan and demonstrate that the project will support economic development. This often includes creating or retaining jobs or supporting community growth..

Frequently Asked Questions (FAQs)

What Is an SBA 504 Loan in Simple Terms?

It is a long-term loan that helps small businesses buy buildings or equipment with low down payments.

Is the SBA 504 Loan Free Money?

No. It is a loan that must be repaid, but it has favorable terms.

Can Startups Get SBA 504 Loans?

Some startups may qualify, especially if the project supports economic development and the owners have experience.

Can SBA 504 Loans Be Used for Rental Property?

No. The property must be mostly owner-occupied.

How Long Does SBA 504 Loan Approval Take?

Approval can take several weeks to a few months, depending on the project and lender.

Is an SBA 504 Loan Better Than a Bank Loan?

For fixed assets, SBA 504 loans often offer better terms than traditional bank loans..

Reference Links

SBA 504 Loan Program Official Page: https://www.sba.gov/funding-programs/loans/504-loans

U.S. Small Business Administration (SBA): https://www.sba.gov

SBA 504 Loan Eligibility Requirements: https://www.sba.gov/funding-programs/loans/504-loans/eligibility

Certified Development Companies (CDC) Information: https://www.sba.gov/partners/lenders/cdc

SBA Loan Comparison (504 vs 7(a)): https://www.sba.gov/funding-programs/loans

Disclaimer

Program Clarity is an independent informational website and is not affiliated with any government agency. This article is for educational purposes only. Program rules and availability may change. Always verify details with official housing authorities.