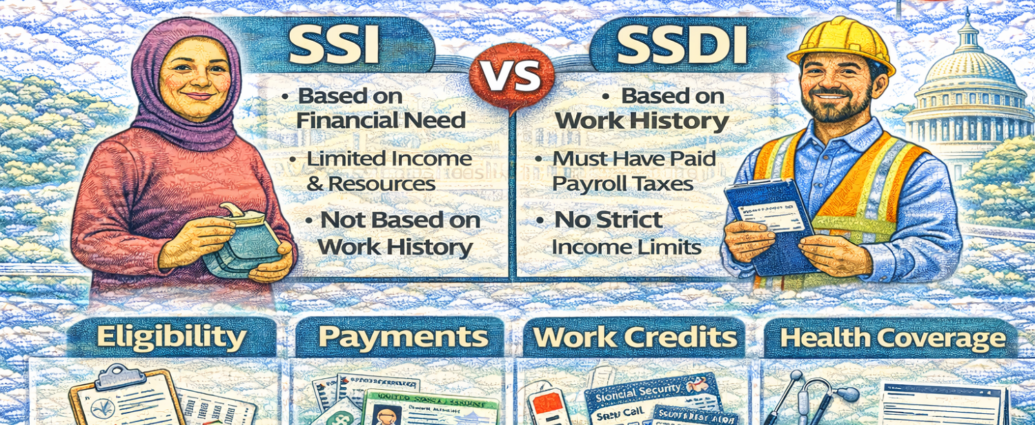

When people hear the terms SSI and SSDI, they often assume they mean the same thing. The names sound similar. Both programs are connected to disability. Both are managed by the same federal agency. Both provide monthly payments. Because of these similarities, many people believe SSI and SSDI are simply two names for the same benefit. This misunderstanding causes confusion, delayed applications, and sometimes financial hardship. In reality, SSI and SSDI are two completely different programs with different eligibility rules, funding sources, and benefit calculations.

Understanding the difference between SSI and SSDI is extremely important, especially for individuals who are disabled, elderly, blind, or unable to work due to medical conditions. Choosing the wrong program or misunderstanding eligibility requirements can lead to denials and long delays. Some people qualify for one program but not the other. Others may qualify for both at the same time. The key is understanding how each program works and how they are different.

What Is SSI?

SSI stands for Supplemental Security Income. It is a federal program designed to help people who have very limited income and very few financial resources. SSI is not based on work history. This is one of the most important points to understand. It does not matter whether a person worked in the past. It does not matter whether they paid Social Security taxes. What matters most is financial need.

SSI provides monthly payments to individuals who are:

-

Disabled

-

Blind

-

Age 65 or older

-

Low income

-

Limited resources

The program is funded by general federal tax revenue, not payroll taxes. This means SSI money comes from overall government funds rather than from Social Security contributions.

SSI is managed by the Social Security Administration. The Social Security Administration evaluates applications, determines eligibility, and issues payments.

What Is SSDI?

SSDI stands for Social Security Disability Insurance. Unlike SSI, SSDI is not based on financial need. Instead, SSDI is based on work history. It is an insurance program. When people work and pay payroll taxes, part of those taxes go into the Social Security system. A portion of those taxes funds disability insurance.

If a person later becomes disabled and can no longer work, they may qualify for SSDI benefits, as long as they earned enough work credits while employed. Work credits are earned based on wages and time worked. The number of credits required depends on the person’s age at the time they became disabled.

The Core Difference Between SSI and SSDI

The biggest difference between SSI and SSDI can be explained in one simple sentence:

-

SSI is based on financial need.

-

SSDI is based on work history.

SSI helps people who are poor and disabled or elderly, regardless of whether they worked. SSDI helps people who worked and paid into Social Security but became disabled before retirement age.

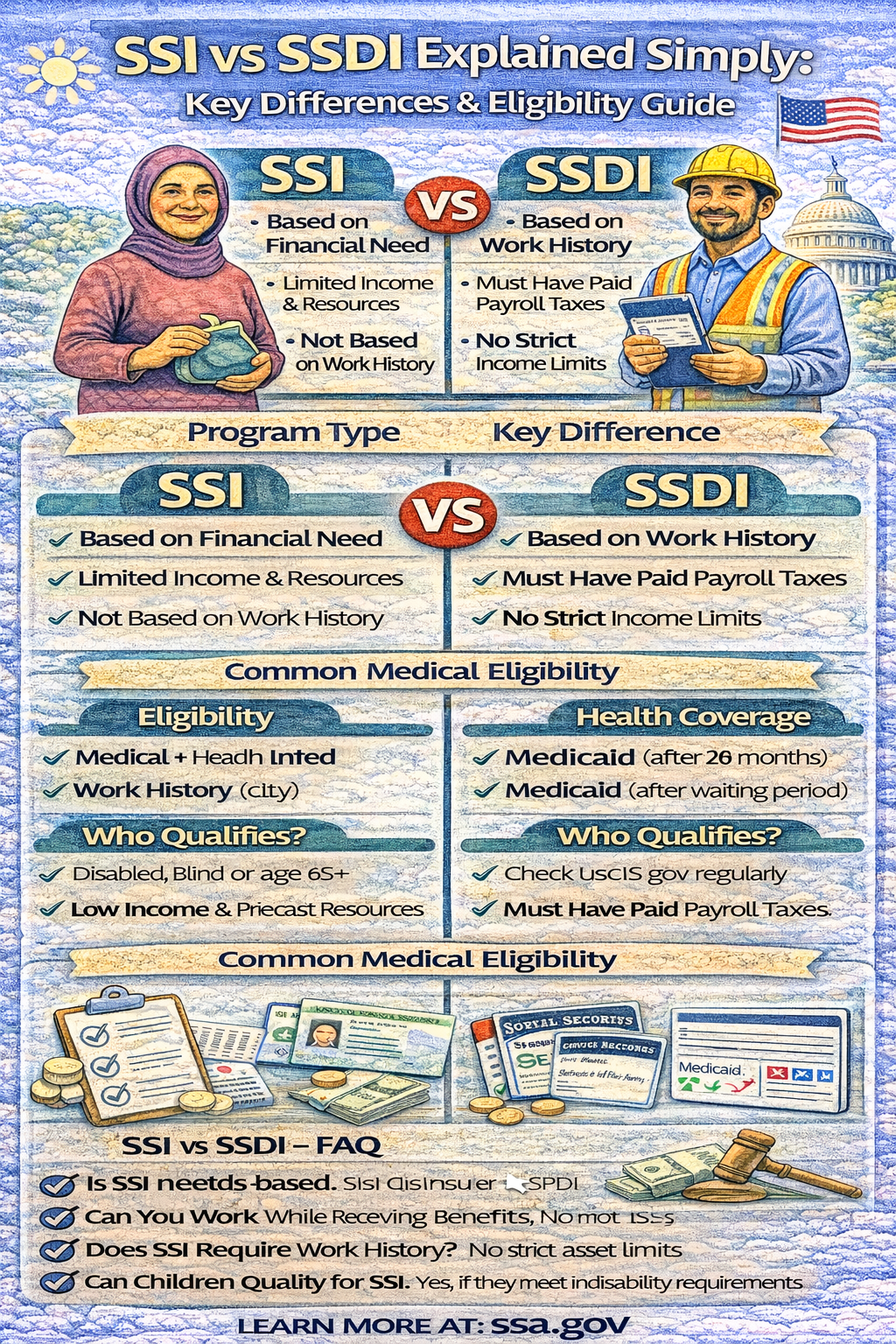

Who Qualifies for SSI?

To qualify for SSI, a person must meet both medical and financial requirements. First, they must either be disabled, blind, or age 65 or older. For disability, they must meet the strict Social Security definition of disability, which means the condition must prevent substantial work and be expected to last at least 12 months or result in death.

Second, the person must have limited income and limited resources. Resources typically include cash, bank accounts, stocks, bonds, and additional property. A primary home is usually excluded, but other real estate may count.

Who Qualifies for SSDI?

To qualify for SSDI, a person must meet the medical disability definition and have earned enough work credits. Work credits are earned by paying Social Security taxes while working. The number of credits required increases with age.

For example, a younger worker who becomes disabled may need fewer credits than someone in their 50s. The system is designed to reflect recent work history.

How Payments Are Calculated

SSI payments are based on a standard federal base amount, which may increase yearly with cost-of-living adjustments. Some states provide additional supplemental payments. However, SSI payments may be reduced if the recipient has other income.

SSDI payments are calculated based on the individual’s lifetime earnings record. The more a person earned while working and paying Social Security taxes, the higher their SSDI benefit may be. This means SSDI payment amounts vary widely from person to person.

Health Insurance Differences Between SSI and SSDI

One of the most important differences between SSI and SSDI is access to health insurance.

SSI recipients usually qualify for Medicaid immediately. Medicaid provides healthcare coverage for low-income individuals.

SSDI recipients generally must wait 24 months after receiving disability benefits before becoming eligible for Medicare. This waiting period can be difficult for individuals who require immediate medical care.

Can You Receive Both SSI and SSDI?

Yes, some individuals qualify for both programs. This situation is called “concurrent benefits.” It usually occurs when a person qualifies for SSDI based on work history but their SSDI payment is very low. If their income remains below SSI limits, SSI may supplement their SSDI payment.

Common Application Mistakes

Many applicants misunderstand eligibility rules. Some assume they must choose one program when they may qualify for both. Others fail to provide sufficient medical evidence. Some misunderstand SSI asset limits and accidentally disqualify themselves.

Frequently Asked Questions (FAQs)

Is SSI the Same as SSDI?

No. SSI is based on financial need. SSDI is based on work history.

Can You Work While Receiving Benefits?

Limited work may be allowed under specific programs, but earnings limits apply.

Does SSI Require Work Credits?

No.

Does SSDI Have Asset Limits?

No strict asset limits, but work income may affect eligibility.

Can Children Qualify for SSI?

Yes, if they meet medical and financial requirements.

How Long Does Approval Take?

It can take several months or longer, depending on the case.

Reference Links

Social Security Administration (SSA): https://www.ssa.gov

SSI Overview: https://www.ssa.gov/ssi

SSDI Overview: https://www.ssa.gov/benefits/disability

SSI Eligibility Requirements: https://www.ssa.gov/ssi/text-eligibility-ussi.htm

SSDI Work Credits Information: https://www.ssa.gov/benefits/retirement/planner/credits.html

Medicaid Information: https://www.medicaid.gov

Medicare Information: https://www.medicare.gov

Disclaimer

Program Clarity is an independent informational website and is not affiliated with any government agency. This article is for educational purposes only. Program rules and availability may change. Always verify details with official housing authorities.