Paying for college is one of the biggest concerns for students and families in the United States. College costs are not just about tuition. Students also need to pay for books, housing, meals, transportation, technology, and daily living expenses. When all of these costs are added together, college can feel impossible to afford. Because of this fear, many students delay college, choose schools they do not really want, or give up on higher education completely. This is where FAFSA becomes extremely important.

FAFSA is often talked about, but it is rarely explained clearly. Many people hear the word FAFSA from schools, counselors, or friends, but they do not fully understand what it is or how it works. Some people believe FAFSA automatically means student loans. Others think it is only for families with very low income. Some are afraid of government forms and avoid applying altogether. These misunderstandings cause students to lose thousands of dollars in financial help every year.

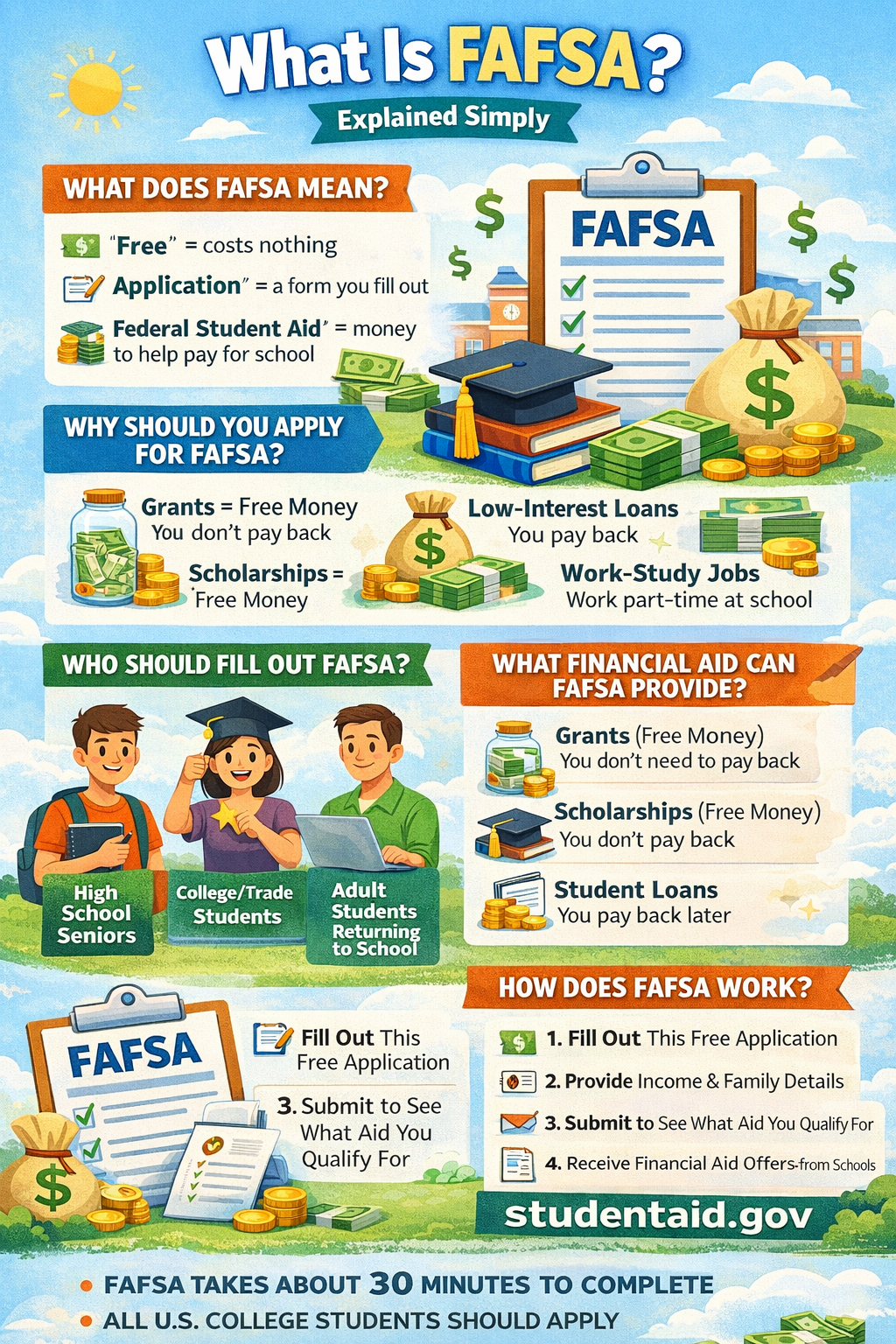

What Does FAFSA Mean?

FAFSA stands for Free Application for Federal Student Aid. While the name sounds long and official, the meaning is actually very simple. FAFSA is a free form that students fill out to ask for financial help for education. The word “free” is very important because you never have to pay to complete FAFSA. If a website asks you to pay money to file FAFSA, it is not official. The word “application” means it is just a form, not a contract or agreement. The word “federal” means it comes from the U.S. government. The words “student aid” mean money that helps students pay for school.

In simple terms, FAFSA is a form that tells the government and colleges that you need help paying for education. It does not promise anything by itself, but it opens the door to many types of financial assistance. Without FAFSA, most students cannot receive financial aid from the government or from colleges.

Why FAFSA Is So Important for College Students

FAFSA is important because it is the starting point for almost all financial aid in the United States. Federal aid, state aid, and even college-based aid often depend on FAFSA information. When you submit FAFSA, your financial situation is reviewed using a standard formula. This helps schools understand how much help you may need.

Many students think they can skip FAFSA if they believe their family earns too much money. This is a big mistake. FAFSA does not only help low-income families. Many middle-income families qualify for grants, scholarships, or reduced-cost loans. In addition, some scholarships and school-based programs require FAFSA even if they are not based on income.

FAFSA is also important because some financial aid is limited. This means that students who apply early may receive more help than those who apply late. Filling out FAFSA on time gives students the best chance to receive the maximum amount of aid available.

Is FAFSA a Loan or Debt?

FAFSA is not a loan. This is one of the most common misunderstandings. FAFSA does not give you money directly, and it does not force you into debt. FAFSA only collects information and determines what types of aid you qualify for.

After completing FAFSA, students may be offered grants, scholarships, work-study jobs, and student loans. Grants and scholarships are free money that never needs to be paid back. Work-study allows students to earn money by working part-time while studying. Student loans are optional, and students choose whether or not to accept them.

FAFSA simply shows what is available. The decision is always yours.

Who Manages FAFSA?

FAFSA is managed by the U.S. Department of Education. This government department is responsible for helping students access education and financial aid across the country. FAFSA is an official and trusted program. It follows strict rules to protect personal and financial information.

Because FAFSA is a government service, it is safe to use when completed through the official website. Students and parents should avoid third-party websites that charge money or ask for unnecessary information.

Who Should Fill Out FAFSA?

Almost anyone planning to attend college or career school should fill out FAFSA. This includes high school seniors, current college students, community college students, trade school students, and adults returning to school. FAFSA is not limited by age. It is also not limited to full-time students only. Part-time students may also qualify for aid.

FAFSA must be completed every year a student is enrolled in school. It is not a one-time application. Even if your financial situation does not change, you still need to submit a new FAFSA each year to continue receiving aid.

What Types of Financial Aid Come From FAFSA?

FAFSA helps determine eligibility for four main types of financial aid. These types work together to make college more affordable.

Grants are one of the most valuable forms of aid because they do not need to be repaid. They are usually awarded based on financial need. The most well-known federal grant is the Pell Grant. Grant money can be used for tuition, books, housing, and other school expenses.

Scholarships are another form of free money. Some scholarships use FAFSA data to help decide eligibility. Colleges often combine FAFSA information with academic records or personal achievements to award scholarships.

Student loans offered through FAFSA are federal loans. These loans usually have lower interest rates and better repayment options than private loans. While loans must be repaid, federal loans are designed to be manageable and flexible.

Work-study programs allow students to work part-time while attending school. These jobs are often on campus and are scheduled around classes. Work-study helps students earn money and gain work experience at the same time.

When and How Often Should FAFSA Be Filed?

FAFSA opens every year, usually on October 1. Students should apply as early as possible. Many states and colleges have their own deadlines, which may be earlier than the federal deadline. Applying early improves the chances of receiving more aid.

FAFSA must be completed every year the student is in school. Missing a year can result in losing financial aid for that year.

What Information Is Needed for FAFSA?

FAFSA requires basic personal and financial information. This includes Social Security numbers, income information, tax records, and bank balances. Dependent students must include parent information. Independent students only include their own information.

The FAFSA form guides users step by step. Many questions are skipped automatically if they do not apply. Help is available through schools and official support resources.

What Happens After FAFSA Is Submitted?

After submission, FAFSA information is reviewed and sent to the schools listed on the form. Each school then prepares a financial aid offer. This offer explains how much aid the student is eligible for and what types of aid are available.

Students can compare offers from different schools and decide which option is best. Accepting aid is always the student’s choice.

What Is FAFSA in Simple Words?

FAFSA is a free form that students fill out to get money help for college or career school. It tells the government and colleges how much financial help a student may need.

Is FAFSA Only for Low-Income Families?

No. FAFSA is for students from many income levels. Even middle-income families often qualify for aid. Many scholarships and college programs also require FAFSA.

Does FAFSA Guarantee Financial Aid?

FAFSA does not guarantee aid, but it is required to be considered for most types of financial assistance. Without FAFSA, students usually receive no aid at all.

Do I Have to Pay Back FAFSA Money?

FAFSA itself does not give money. Some aid offered through FAFSA, like grants and scholarships, does not need to be paid back. Loans must be repaid only if you choose to accept them.

Can Parents Refuse to Share Information on FAFSA?

If a student is considered dependent, parent information is required. Without it, the student may not qualify for most types of aid. However, special circumstances may allow exceptions.

Can I Fill Out FAFSA Without My Parents?

Independent students can complete FAFSA without parent information. FAFSA determines dependency status based on age and life situation.

Is FAFSA Hard to Fill Out?

FAFSA is easier than many people think. Most students complete it in under one hour. The form includes help tips and automatic tools to reduce errors.

What Happens If I Make a Mistake on FAFSA?

Mistakes can be corrected after submission. Students can log in and update information if needed. Corrections are common and usually easy to fix.

Can FAFSA Be Used for Community College?

Yes. FAFSA can be used for community colleges, trade schools, technical schools, and universities.

Is FAFSA Safe to Use Online?

Yes, as long as you use the official FAFSA website. FAFSA uses strong security systems to protect personal information.

What If I Miss the FAFSA Deadline?

Some aid may still be available, but missing deadlines can reduce how much help you receive. It is always best to apply as early as possible.

Can International Students Apply for FAFSA?

Only U.S. citizens and eligible non-citizens can apply. Some schools offer separate aid programs for international students.

Reference Links

-

Official FAFSA Application: https://studentaid.gov/h/apply-for-aid/fafsa

-

Federal Student Aid Overview: https://studentaid.gov

-

FAFSA Deadlines: https://studentaid.gov/apply-for-aid/fafsa/fafsa-deadlines

-

U.S. Department of Education: https://www.ed.gov

Disclaimer

Program Clarity is an independent informational website and is not affiliated with any government agency. This article is for educational purposes only. Program rules and availability may change. Always verify details with official housing authorities.