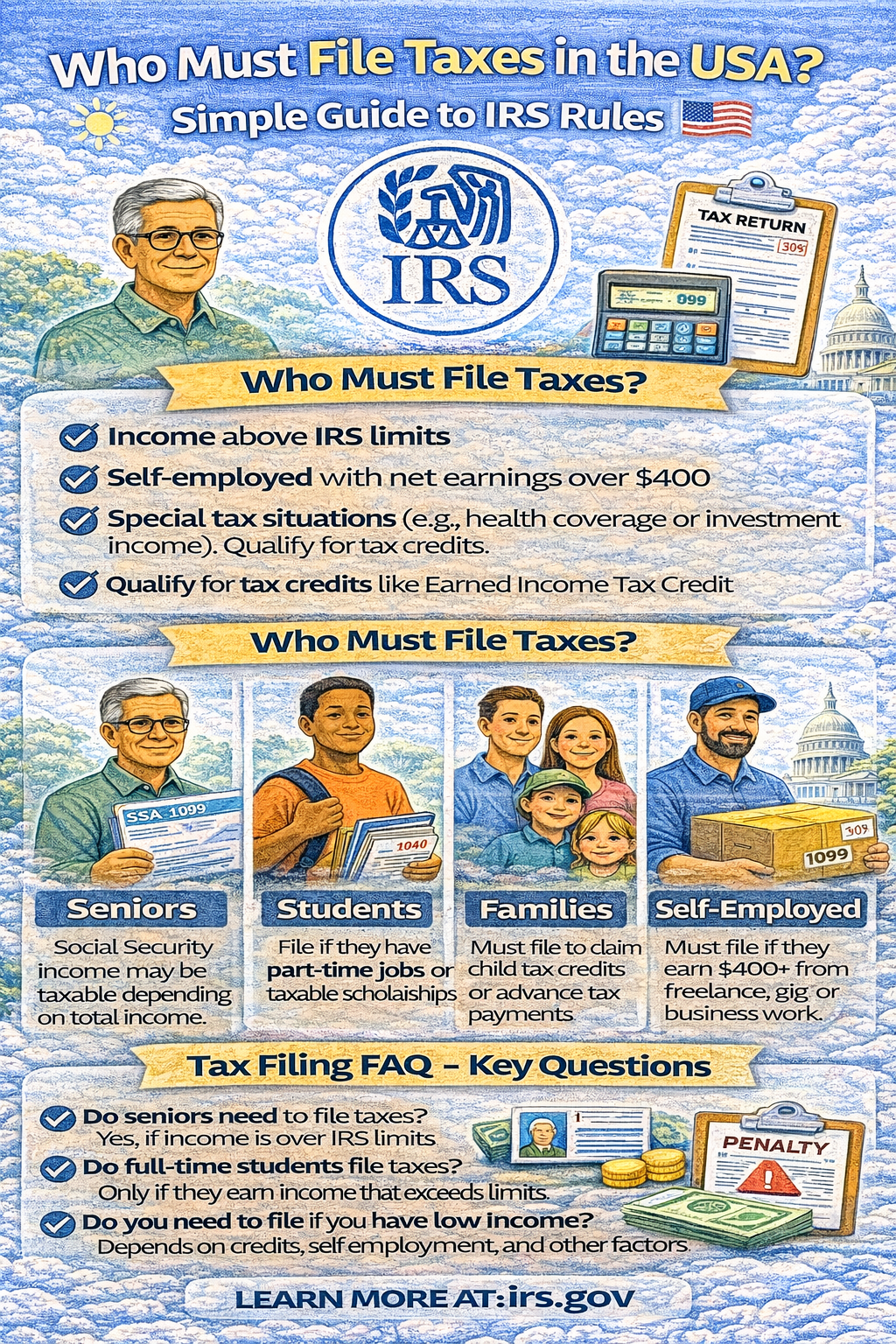

Many people in the United States feel confused every year when tax season arrives. One of the most common questions people ask is, “Do I have to file taxes?” Some people believe only rich individuals must file taxes. Others think filing is optional if income is low. Many students, seniors, immigrants, and part-time workers are unsure about their tax responsibilities. Because of this confusion, people either fail to file when they should or file unnecessarily when they are not required to.

Filing taxes is an important legal responsibility in the United States. The government uses tax returns to determine how much tax a person owes or whether they are owed a refund. Filing taxes is also required to qualify for certain benefits, credits, and government programs. Missing a required tax filing can lead to penalties, interest, and problems in the future.

What Does It Mean to File Taxes?

Filing taxes means submitting a tax return to the government, usually to the Internal Revenue Service. A tax return reports how much money a person earned during the year and how much tax they already paid. Based on this information, the government decides whether the person owes more tax or should receive a refund.

Who Decides Who Must File Taxes?

Tax filing rules in the United States are set by federal law and managed by the Internal Revenue Service. The IRS sets income limits, filing thresholds, and special rules for different situations.

Each year, the IRS publishes updated guidelines that explain who must file a federal tax return. These rules can change based on income limits, filing status, and age.

Who Must File Taxes Based on Income?

Most people must file taxes if their income is above a certain amount. The amount depends on filing status, age, and type of income.

For single individuals under age 65, filing is usually required if income is above a minimum threshold set by the IRS. Married couples filing jointly have higher income limits. Seniors often have different thresholds.

Income includes wages, salaries, tips, self-employment income, interest, dividends, unemployment benefits, and other taxable income. Even if income comes from multiple small sources, it may still require filing.

Filing Taxes for Single Individuals

Single individuals must usually file taxes if their gross income exceeds the IRS filing threshold for the year. This applies to full-time workers, part-time workers, and people with multiple jobs.

Even students and young workers may be required to file if income exceeds the limit. Many people are surprised to learn that age does not remove the obligation to file taxes.

Filing Taxes for Married Couples

Married couples can choose to file jointly or separately. Filing jointly usually has higher income limits before filing is required.

If one spouse earned income and the other did not, filing may still be required. Married individuals filing separately often have lower income thresholds and may be required to file even with low income.

Who Must File Taxes If Self-Employed?

Self-employed individuals must file taxes if they earn income above a very low amount. This includes freelancers, gig workers, independent contractors, and people with side businesses.

Even if total income is small, self-employed individuals may still be required to file because of self-employment taxes. Many people who drive for ride-sharing services or sell products online fall into this category.

Who Must File Taxes Even With Low Income?

Some people must file taxes even if their income is low. This includes people who owe special taxes, received advance tax credits, or earned self-employment income.

People who want to claim refundable tax credits, such as certain child or education credits, must file a tax return to receive those benefits.

Filing Taxes for Students

Students often believe they do not need to file taxes. This is not always true. Students who work part-time, receive scholarships, or have investment income may need to file.

Scholarships used for tuition are usually not taxable, but money used for living expenses may be taxable. Filing helps students receive refunds or credits they may qualify for.

Filing Taxes for Seniors

Many seniors must still file taxes. Social Security income may be taxable depending on total income. Seniors with pensions, retirement accounts, or investment income may be required to file.

Age alone does not remove the obligation to file taxes.

Filing Taxes for Immigrants and Nonresidents

Immigrants living and working in the United States may be required to file taxes, regardless of immigration status. Nonresident aliens have special filing rules.

Anyone who earns income in the United States may have a tax filing obligation.

Who Does Not Have to File Taxes?

Some people do not need to file taxes if their income is below the filing threshold and they do not meet any special conditions. This may include individuals with very low income and no taxable benefits.

Why Filing Taxes Is Important Even If Not Required

Filing taxes can help people receive refunds, tax credits, and proof of income. Many government programs require tax returns as part of eligibility.

Frequently Asked Questions (FAQs)

Do I Have to File Taxes If I Made Very Little Money?

It depends. You may not be required, but filing could help you get a refund or credits.

Do Students Have to File Taxes?

Students may need to file if they earned income or received taxable scholarships.

Do Seniors Have to File Taxes?

Yes, many seniors must file if income exceeds IRS thresholds.

Do I Have to File Taxes If I Am Self-Employed?

Yes, self-employed individuals often must file even with low income.

Do Immigrants Have to File Taxes?

Yes, anyone earning income in the U.S. may have a filing requirement.

What Happens If I Do Not File Taxes When Required?

Failing to file may result in penalties, interest, and future problems.

Reference Links

Internal Revenue Service (IRS) Official Website: https://www.irs.gov

Who Needs to File a Federal Tax Return: https://www.irs.gov/individuals/who-needs-to-file

IRS Filing Status Information: https://www.irs.gov/filing

Self-Employed Tax Filing Requirements: https://www.irs.gov/businesses/small-businesses-self-employed/self-employed-individuals-tax-center

Tax Rules for Students: https://www.irs.gov/individuals/students

Tax Rules for Seniors and Retirees: https://www.irs.gov/individuals/retirees

Tax Information for Immigrants: https://www.irs.gov/individuals/international-taxpayers

Disclaimer

Program Clarity is an independent informational website and is not affiliated with any government agency. This article is for educational purposes only. Program rules and availability may change. Always verify details with official housing authorities.